Protecting yourself from inflation

Posted by Luke on the

Filed under economics

Your currency is worthless.

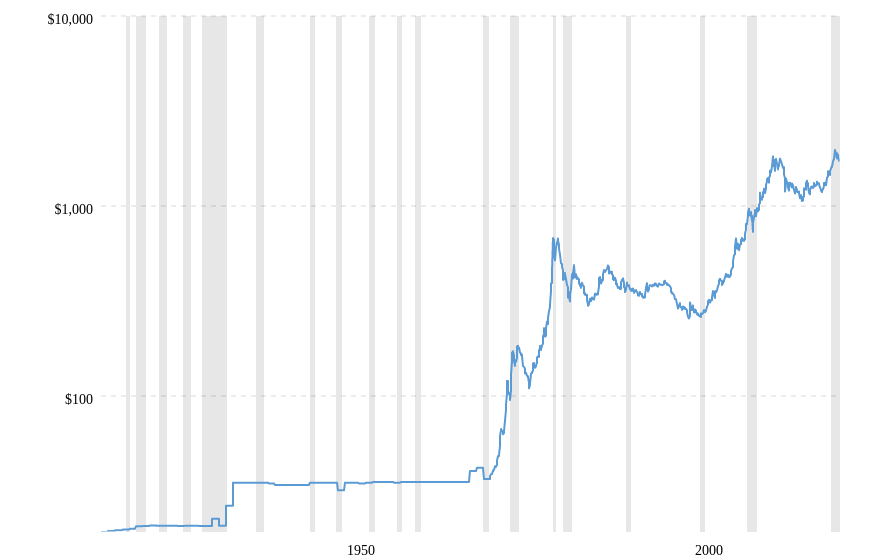

When priced in gold, you can see that over the last hundred years (see the graph below), the US Dollar has lost all of its value. The graph below plots the price of gold per ounce against the USD from 1915 to present. In 1915 the price of an ounce of gold was $19.25. When the dollar was created in 1792, the cost of gold was $18.60 per ounce, which we will refer to as the baseline value of the dollar. Between 1792 and 1915 (123 years) the price of gold only increased by 65 cents (roughly half a cent per year in inflation or an average of 0.028% p.a.). During this period, wages were relatively flat, however, America also became heavily industrialised, and the cost of living reduced by half. So, not only did the value of your money remain flat, you were able to buy more goods.

You'll note that the price of gold was flat until ~1932 when the government decided that it needed to devalue the currency, so it could create more dollars (since they were on a gold standard, they could only have as many dollars as you had gold reserves), so the legislature re-defined the value of an ounce of gold to be $35. Back then, it was a simple change of definition, since the dollar was still tied to, and redeemable in gold and silver. You'll notice that all hell breaks loose in 1971 when America left the gold standard (duping the entire world into accepting fake money tied to no real world value for their exports), and people were no longer allowed to redeem gold for their dollars (including foreign investors). Between 1971 and today, the price of gold rose from $36.56 to $1715.24 (as of March 2021). That is a face-melting 4591.56% inflation rate in 50 years, or an average of 91.8% per year.

The graph begins shortly after 1913 when the Federal Reserve Act was passed (creating the Federal Reserve), and the Sixteenth Amendment was ratified (allowing for the government to tax income). The Federal Reserve was intended to be an apolitical, non-government organisation to allow the creation of money to be separate from the legislature. That seems ridiculous in hindsight today, as the Fed and the legislature are just two sides of the same spending-addicted coin, hell-bent on debasing the currency no matter the cost. This isn't anything new; the Fed has been monetising the government's debt since the inception, but I think the wheels came off when legislature made the decision to leave the gold standard to fund their war machine abroad. The few checks and balances that previously existed evaporated. Before the legislature could vote to devalue the dollar, allowing the Fed to print more money, but after leaving the gold standard, the Fed now digitally prints tens of billions of dollars per month to buy treasury bonds to fuel the stock market bubble. Similarly, the income tax was another ill-fated policy. Originally, the income tax rate was 1% for people earning $0 to $20,000 (which is ~$529,911 today, according to the CPI, or $1,782,067 when priced in gold) with a top nominal tax rate of 7%. Clearly, in hindsight, these low rates were the camel's nose under the tent, and this was the government laying the groundwork for massive tax hikes during World War I (yet another war America didn't need to be involved in). By 1918, the top nominal tax rate was a whopping 77%.

All of that background is just to highlight the state of decay America is in which continues to accelerate as government grows. The reason I like to view inflation through the lens of gold price is because gold has been used as money for thousands of years, which is a much more meaningful time-scale than the ~240 years the USD has been in existence. Interestingly, when you price the Dow Jones index in dollars, it's at a record high of $32,981.55 (compared to the $1457.37 in 1915), which is an increase of 2163%, however, when you price it in ounces of gold, today it's at 19.23Oz (as compared to the 2.86Oz in 1915), that's an increase of 572.4%. A far cry from the >2,000% when measured in dollars.

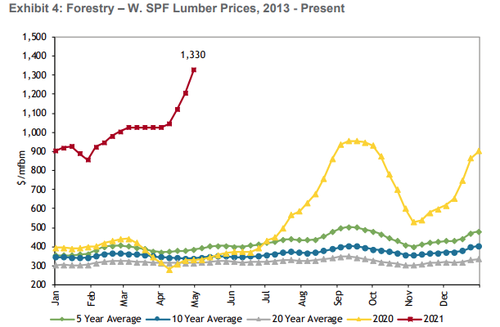

Now that you're caught up on the historical horrors of the US dollar, we can talk about the present horrors. 40% of all dollars in existence were printed in 2020, and already in 2021 there has been nearly half a trillion dollars added to the national debt. The CPI is the measure of inflation we typically use (which is actively manipulated to understate the true increase in goods prices), and in March 2021 alone, it measured a 2.6% increase. It is no longer a conversation of "massive inflation is coming". Massive inflation is HERE! Look at the price of lumber for example (see below), which has had a 47% increase so far this year, after a 125% increase last year.

It should be clear from the preceding rant that I believe gold is the best way to hedge yourself against inflation, especially since, unlike wheat and oil, it never decays. Remember, it's not that gold is getting more expensive, it's that the dollar is getting weaker. So, trading precious metals for commodities to hedge yourself against currency fluctuations is the best course of action. What should you do if you don't have the available capital to buy gold? Firstly, you can buy much larger quantities of silver for far lower prices than you can buy gold, and it's more viable for everyday exchanges because it's more divisible.

Assuming you can't buy silver either, you should not let your money wither away at 0% interest in the bank or risk losing it on overpriced stocks (I'm not advising you pull your retirement funds out of the market, but you could consider mixing in some inflation hedges like gold and gold mining stocks). The best thing you can do locally is stock up on goods that you know you will need down the road. In 2017 Mark Cuban (Newly converted Bitcoin bull) said that people struggling to get ahead should buy in bulk and on sale. In hindsight, this was fairly prophetic considering where we are today. Many goods on the shelves are experiencing unprecedented price surges, and that doesn't even address the real possibility of serious goods shortages in the near future. Start working out how much of each non-perishable good you use per month and extrapolate that for a year. Here are some ideas for you:

Toilet paper

If you use 4 rolls a month, that works out to 48 per year. Buy four 24 packs and you are set for two years without buying toilet paper. Make sure you store it in a cool, dry place.

Laundry detergent

This is rather self-explanatory, but you should be wary that powdered detergent only has a shelf life of 6 months, so consider using liquid detergent.

Toothpaste

Colgate recommends a maximum of two years shelf life, so don't buy too much

Other examples

You can really go hell for leather with this, just consider if you have the right conditions in your house to store them long term.

- Toothbrushes

- Tissues (or switch to washable cloth handkerchiefs)

- Dehydrated meals

- First aid supplies

- Powdered milk

If you are curious about getting started buying precious metals, check out Schiff Gold for Americans, and Perth Mint or ABC Bullion for Australians. If you are worried about inflation, you should steer clear of buying gold/silver ETFs as you don't have the security of physical metal, and it can be easily seized by the government. With a gold broker like the above, you can store it at their secure facilities and request redemption at any time. I don't keep any physical metals as I don't have anywhere to securely store it, but a bank safe deposit box would be a good alternative.

Good luck out there everyone.